Your Profile & Earnings

Profile

Please ensure that you always keep your personal and vehicle information up to do with our system. You can request changes to your information inside the driver app.

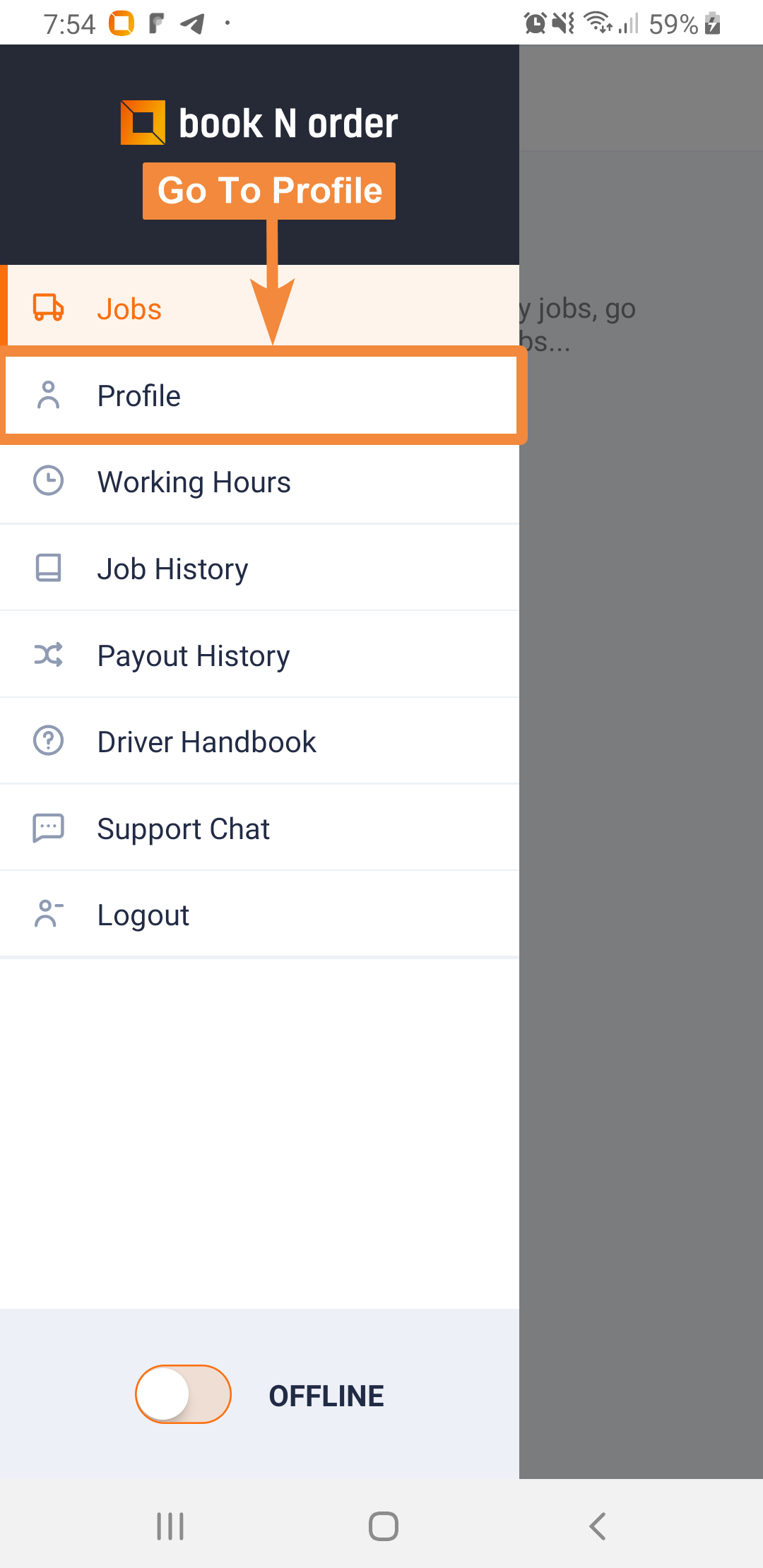

Go to your profile page

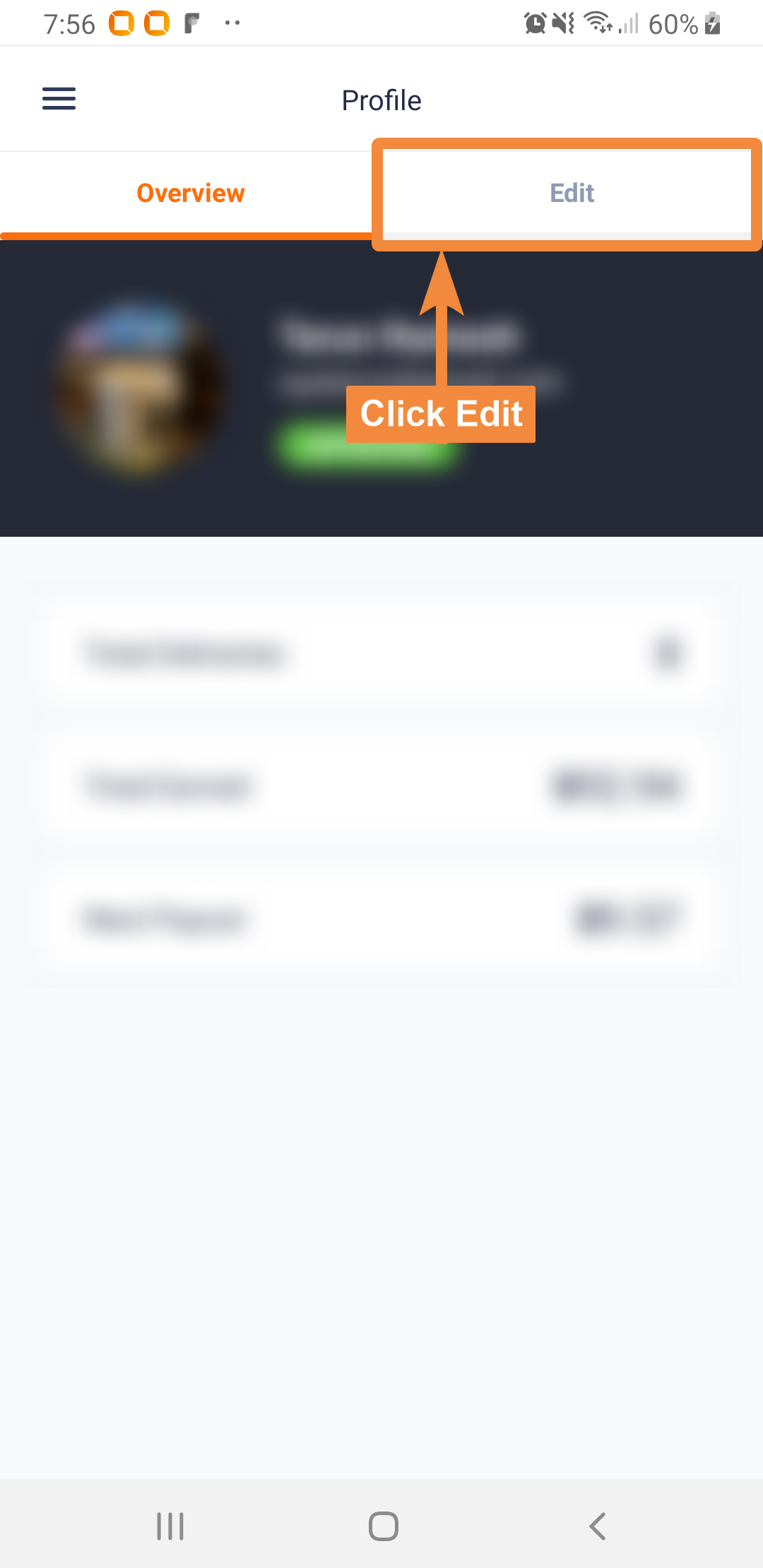

Click the edit tab

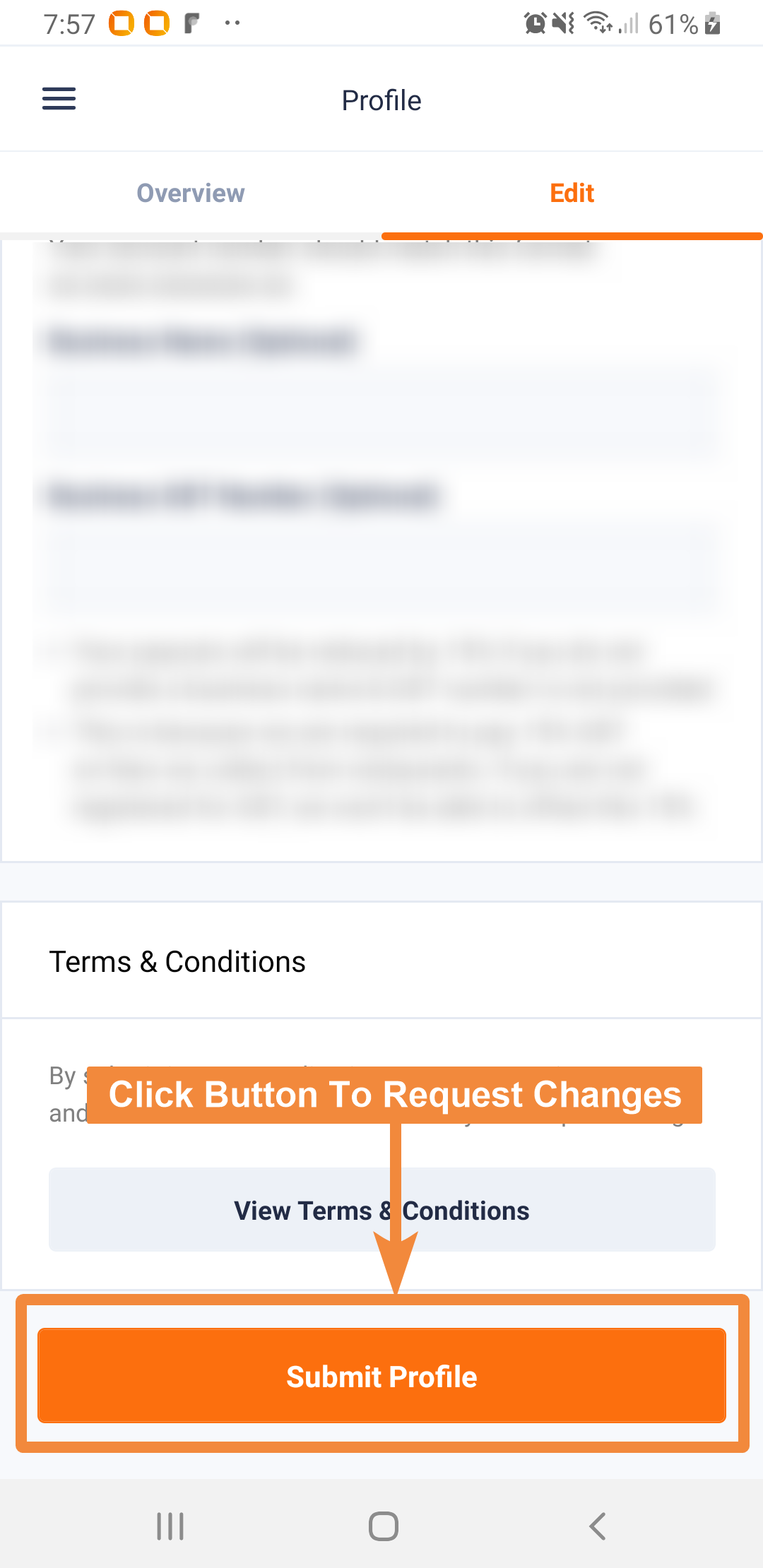

Make any modifications to your profile information here. Once done, scroll to the bottom and press the "Submit Profile" button

Earnings & Payouts

Your payout will be sent every Monday morning. This will include payments for any deliveries completed over the previous week (Monday to Sunday).

You can view your upcoming payout amount inside your profile page. You can also view the history of all your payouts inside the "Payouts History" page in the app. Clicking on the invoice button on that page will give you an official invoice with a list of jobs which were completed in that payout

How GST Impacts Payouts

To pay you out, we will charge the restaurant for delivery fees. When charging restaurants, we must collect GST on those charges. When paying you out, if you are not registered for GST we are not able to add the GST component to your invoice. As such your payout from us will be less than 15% GST.

This is how it plays out in practice:

- Customer Pays Restaurant $9.50 for the delivery

- The restaurant is GST registered, so from the $9.50, $1.24 is GST and they must pay the government that amount

- We then bill the restaurant $9.50, $1.24 of that is GST and we must pay the government that amount

- Since the restaurant owes $1.24 GST to the government but also paid $1.24 GST to us, the two cancel out. The restaurant now doesn't owe any GST

- Here we will pay you out but say you are not GST registered, if we pay you out $9.50, we still owe the government $1.24 GST. This means our total cost would be $10.74. In effect, we are losing money every time you do a delivery

- To offset this, we have to reduce your payout by $1.24 so your final payout is $8.26

If you are GST registered, we can pay you the full $9.50. In this scenario, we will be in a similar position to the restaurant and can offset our GST against the GST we paid you